Alan's Investing Guide

Last Updated 4/20/2020My Best Advice

- Invest Early

- Invest Consistently (Dollar Cost Average)

- Diversify by buying Stock Indexes

- Keep Learning

- Don't Gamble

Invest Early

The Conundrum..... When you are young you don't have much money. You think if you wait until you are older you will have more money to invest. What you have right now is time. Later on you probably will have more money, but you won't have time. Start investing now and keep going until you are ready to retire. Invest what little you have now (10% to 20% of your income), and over time this will grow to a significant value.

LEARN: YouTube video on Investing Early

Invest Consistently (Dollar Cost Average)

By consistently investing, you will be able to take advantage of the markets ups and down. This is generally know as dollar cost averaging.

LEARN: YouTube video on Dollar Cost Averaging

Diversify by using Index Funds

Over Time the Stock Market Grows by about 7.5% per year. If you don't want to worry about trying to research individual stocks,then just invest in a good index fund and rest easy, OVER TIME, the diversification will provide you with groth every year over inflation.

LEARN: YouTube video on Index Funds vs. Individual Stocks

Keep Learning

You are in control of your future. If you say I don't understand about investing, or stocks, or other financial stuff... then welcome to the club. You just aren't done learning yet. This is your future, so make it the best it can be by spending some time learning how to make some good choices to secure the best financial future you can for yourself. YouTube is your friend. There is so much good stuff on investing it is up to you how much you want to learn.

LEARN: YouTube video - Dave Ramsey - lots of good stuff from this guy.

Don't Gamble

Many people like to gamble. Buying individual stocks is fun. You might think you know what companies are going to go up, or down. In almost all cases you know nothing about the leaders at the company, just what the company does. You are in no position to have much knowledge about what is really going on there, if there is a future or not other than what you can read in the news on the internet. Internet 'experts' are mostly just people like me and you with their own uniformed opinions. Gold and cryptocurrencies are worse. If you have the time, and want to play that game, then I wish you good luck. If you want the safer, more steady road, then skip on the speculation, or at least minimize this to a small percentage of your portfolio. If you enjoy this then limit individual investments to under 10% of your portfolio.

LEARN: YouTube video on Investing in Single Stocks

Stock Market Dips

If you are young and the stock market goes down, that is a very good thing for you. That is a buying opportunity that will allow you buy shares at a low price and the chances they will appreciate more than the average 7% a year is very high. Since you will be dollar cost averaging anyway, you will take advantage of these deeps. If you have any extra money you can invest at this time then it is a great time to add it to your consistent investment.

2020

Here is my opinion on where things are at in April 2020:Stocks

The recent stock market high was in mid-February 2020. After the coronavirus started to spread around the world the market quickly crashed, on recently went significantly down 37% bottoming out on March 23, 2020. As of April 15, 2020, the market bounce back significantly up 25% from the low, still down 21% from the high.In my opinion on April 15, 2020, I see things in the economy this way:

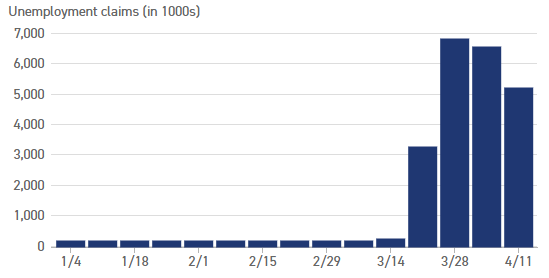

- Most of the world is not working at their jobs. In the United States unemployment just went from 3% to about 13% in a few weeks. This number is likely to grow as the globe maintains social distancing which has shut down hospitality, travel, restaurants, sporting events, concerts, theaters, etc. The longer we are 'closed down' the deeper the recession will be and the harder it will be to 'get back to normal'. We really won't be back to normal until lots of people have already been infected and recovered from COVID-19 or there is an immunization.

- The government has just printed a boat-load of money to pay for stimulus programs and to prop up the markets.

- The stock market is being manipulated by the government and large investors. There is little correlation between news and the market activity. Although the market usually predicts events rather than waiting for the headlines, this is a crazy roller coaster ride we are on that seems very disconnected with the current news. For example, the news for jobless claims were super high, and the market rose that day 10%.

- Since the government is printing so much money and paying people and businesses affected by the shutdown, many people think that Gold, Silver and other precious metals will rise significantly.

- Bitcoin and cryptocurrencies. Who knows what these things will do? When COVID-19 first affected the economy, Bitcoin went down. There is a current 'halving' coming up which has previously precipitated a run up, but who knows what will happen this round. Crazy times!

I think there will be a significant move down (shown in red) as the news comes out for how devastating this global shutdown and continued social distancing will be on the economy.

Unemployment

Unemployment went from around 3% to almost 20% in four weeks time. As the country still remains closed, the number of people being laid off will continue to grow. We will 'open up the country' slowly, so even though some jobs will come back, a large number will still be out of work. The longer we remain close, and the longer we have to social-distance, the worse economic impact this will have.

Market Prediction and Manipulation

These days news and market movements up and down are pretty disconnected. You might think that a lot of people losing jobs would cause the stock market to go down. This now famous image shows huge unemployment numbers and the 'best week since 1938'. The stock market moves in part by predicting the future. It also moves in part by very wealthy institutions (groups of wealthy investors) that 'move' the market, or manipulated the market by concerted actions to buy or sell at certain times creating a temporary spike in supply or demand thus forcing the market one way or another.

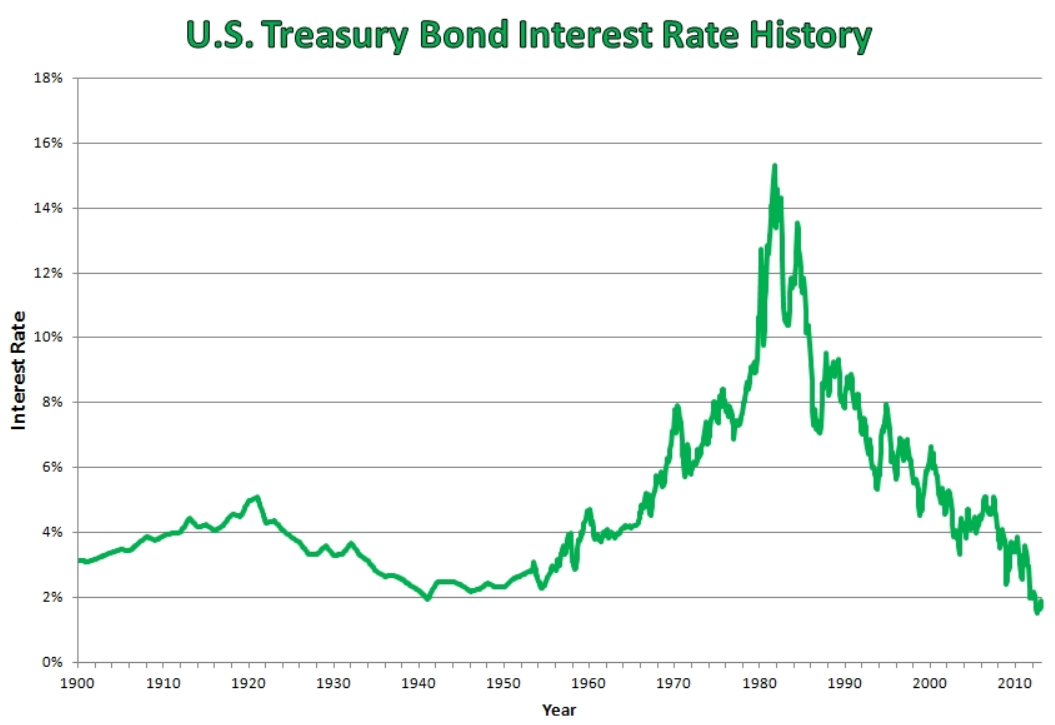

Bonds

Bonds are lower than they have EVER been. Bonds are BELOW 2%. This has NEVER happened. Simply put, the only direction bond yields can go right now is up. Right now in my humble opinion it is pretty ridiculous to buy bonds. With nearly negative interest rates, bond can't appreciate and can really only go down as interest rates rise back up again over the years. With all the recent borrowing lately, this is almost a certainty that we will hit an inflationary period. When interest rates go up, the price of bond go down. You can lose money on bonds. I will say it again, if interest rates go up, you lose money on bonds. When interest rates are at zero, where can they go? Up. Can they go down? Not really.Historical Bond Prices:

LEARN: YouTube video on the inverse relationship of bonds and interest rates Bond ETF: LQD

In the past 120 years, have bonds been lower than 2%. Nope. These are unprecedented times. Really, this hasn't happened before.

Gold

The biggest problem I have with gold is that year after year gold does nothing except sit there and glitter. It doesn't make food, or phones, or provide a service. One of the most revered investors, Warren Buffet has a view on gold that I agree with. https://www.fool.com/investing/does-warren-buffett-invest-in-gold.aspx It is just a blob of metal that is rare and sought after for manufacturing, jewelry, and speculation.

Bitcoin and Cryptos

I don't believe the cryptocurrencies should be a significant part of anyones portfolio.

ROTH IRAs

The best thing about ROTH IRAs is that they grow tax free. When you withdraw from them in many years to come, the gains are tax free. If you have a low tax rate now, you can take advantage of this by investing now with taxed dollars, then have the investments grow tax free.

ETFs

Electronically Traded Funds are in my opionion the best way to invest in the markt. The ETFs are very similar to an Index Fund with some slight differences.

Indexes

You here so much about the 'DOW', the 'S&P' and a few others such as the NASDAQ and the Russell 2000. What the heck are these. They are simply lists of companies. I recommend buying these indexes since you will see them in the news ALL THE TIME. If you don't follow financial news closely, buy one of these popular indexes which grow about 8% per year and you will do good.

Lose the Stress and Take 7% or 8% a Year

You don't have to wake up every morning wondering what your stock did today. Just buy an index fund and continue to dollar cost average in that fund. Don't stress, don't time the market, just keep putting money into it and it will grow on average 8% a year (7% if you take into account inflation). https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp If you save 10% to 20% of year of your income and fully invest it in an index fund, you will have very low risk, consistent growth, low stress, and a happy retirement. You will have more financial wealth than most of the other people on this planet. This is my recipe for success, based on my business experience (running a successful small business for 20 years), education (BS in Engineering and a MBA), and observations (making a few mistakes and some good choices) over the last 30 years.

Greed

Here are some lessons I have learned along with a few other of my relatives.

- Back in the late 1990s I thought it would be good to invest in the dot com craze. $40,000 of my wife's retirement account were invested in the hottest dot com stocks that ended up going down to zero. Wow, that was painful.

- Back in the late 1990s, someone close to me had invested heavily in stock options. He had $1,000,000 worth of a stock that 'was sure to go up'. He lost it all.

- More recently when the Bitcoin went up to $19,000 along with other cryptos, someone close to me had a value of $3,000,000 in their cryptos. When it went back down, his portfolio dropped down to around $400,000. Ouch.

The moral of the story - don't get greedy and don't speculate. If you have gains, take them off the table. If you are so sure things are going to keep going up, there are many examples where they don't.

What is the Dow?

What is the S&P 500

What is the NASDAQ

Some More Advanced Stuff

Bear Funds

Here is some information on Bear Funds.

..

alanharmon.net