AlanHarmon.net

Various Thoughts and Useful Information

The "Set-It and Forget-It" Long-Term-Investing Portfolio

9/19/2023

DISCLAIMER: This is what I AM DOING. What you should do depends entirely on your circumstances, and I am not necessarily recommending that this is what you should do. For Financial Advice, you should seek a financial advisor.

The Set-It and Forget-It Portfolio

This portfolio works best for Long Term Investing. That is money that you will not need to touch for over 10 years at the minimum. If your timeframe is shorter, then this portfolio is probably not for you. This portfolio will probably lose money at some point over time, but in the long run, it should offer considerable growth while minimizing risk when compared to other investment options.People love to try to pick stocks. Very few people are able to perform better than the S&P 500 Index fund over a ten-year timeframe. Some ‘stock pickers’ will be able to find the ‘next Tesla’, but it is most likely due to luck, rather than stellar stock picking skills, and most often, the big winners will be offset by big losers. A more prudent approach is to simply invest in strong Index Funds like the S&P 500, or you can even diversify this approach with a 6-Fund Portfolio shown here that balances diversification, growth, and some stability.

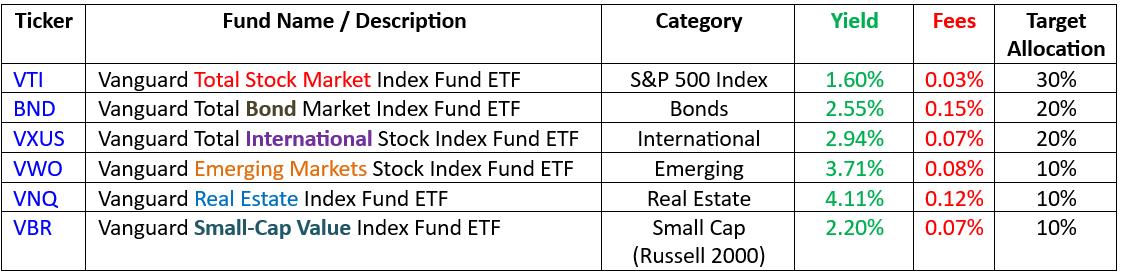

6-Funds

This portfolio composed of six ETFs is balanced for growth and stability, with diversification in a mix of Large Cap Stocks (VTI), International Exposure (VXUS), High Growth Economies (VWO), Real Estate (VNQ), High Growth Stocks (VBR), and safety in Bond Funds (BND). All these ETFs do pay dividends, so there will be some return on the investment of a few percentage points per year, even if the individual share price declines.

So You Want To Buy Your Own Stocks….

If you have the itch to play the market yourself, then a good strategy is to give yourself a small percentage to ‘play with’ such as 5% or 10%, then have at it and figure out if that is really what you want to do and if you are good at it. Always compare how you are doing against the funds listed above, and if you are not, then consider just sticking to the 6-Fund Portfolio Plan.How to Invest

This approach will work for nearly any long-term investment strategy. • Lump Sum • Incremental Investing over time • Any combination of the two aboveSources

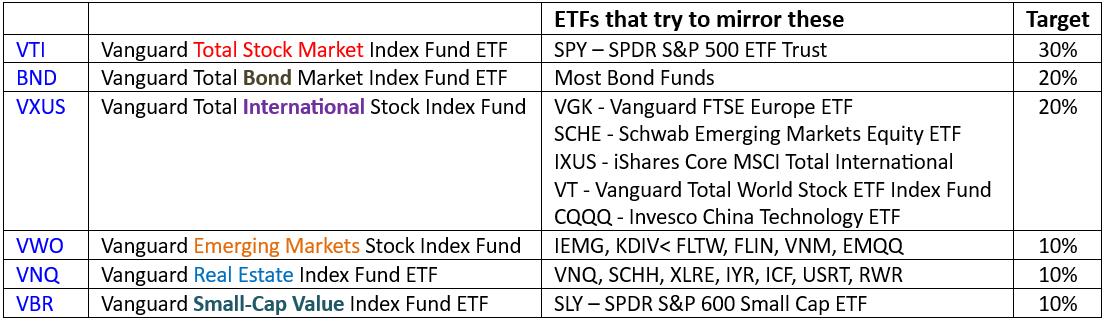

The specific funds chosen were from a video by Rob Berger with a click bait title of “How to Invest a Million Dollars”, but this video details how this is a great approach for any long-term investment strategy. It is located here: https://youtu.be/ikFhiIKglosIf you don’t have access to the Vanguard Funds, here are some equivalents?

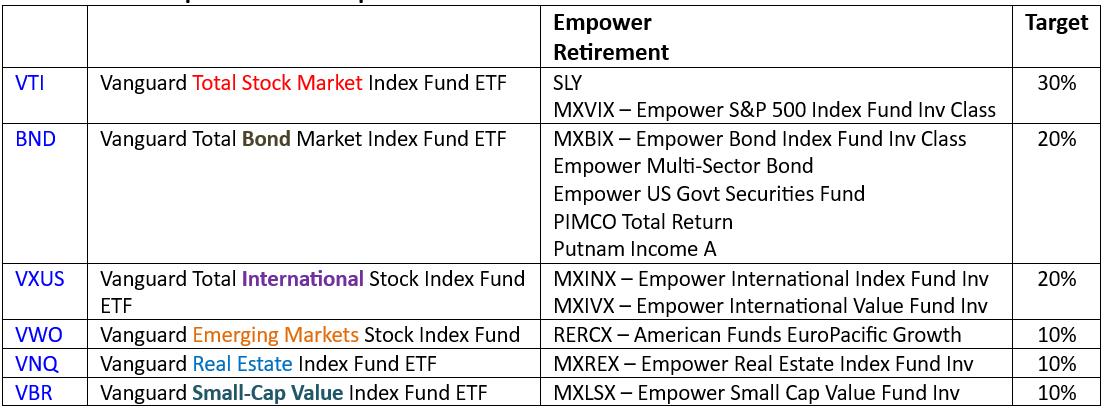

What are some equivalents for Empower Retirement?

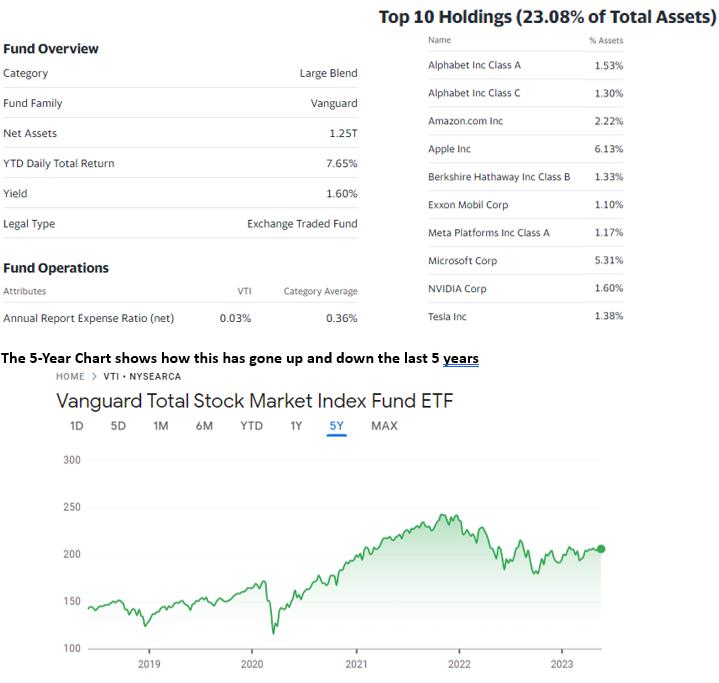

VTI (30% of your Portfolio)

The Vanguard Total Stock Market Index Fund ETF mirrors the S&P 500 Index, with the stability of some of the largest companies in the world, like Google, Amazon, Apple, Exxon, Facebook, Microsoft, NVIDIA, and Tesla making 23% of the fund. This is probably going to be the most successful ETF in the portfolio.

BND (20% of your Portfolio)

Bonds offer some stability to your portfolio. In 2023, this has been less true due to the historically low Prime Rates set by the Federal Reserve and other world banks. The funds do offer dividends, so they will consistently provide some growth, even as bond rates go up and down. This bond fund makes it easy, but individual bonds could be purchased as well for this part of the portfolio saving 0.15% yearly expense fees, and reduces some of the share price ups and downs.

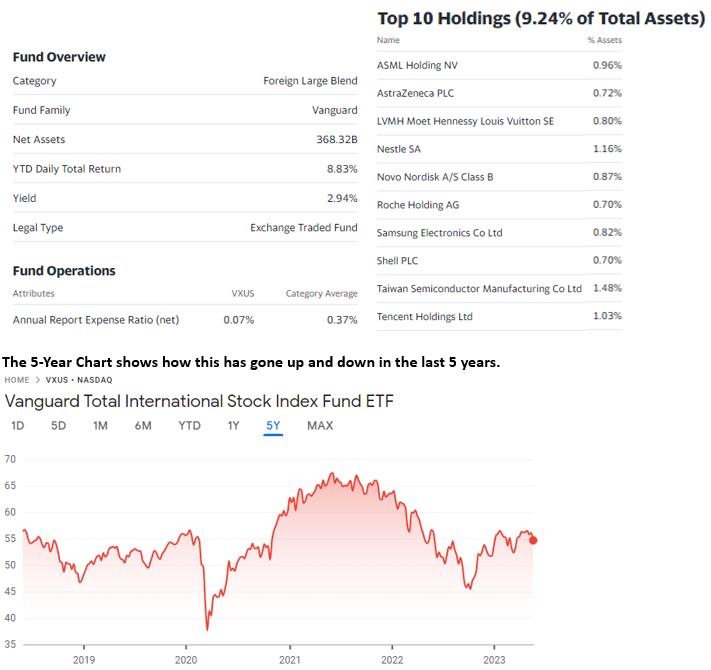

VXUS (10% of your Portfolio)

This Fund offers diversification, adding International Stocks to your portfolio. Markets outside the United States don't always rise and fall at the same time as the domestic market, so owning pieces of both international and domestic securities can level out some of the volatility in your portfolio. This can spread out your portfolio’s risk more than if you owned just domestic securities.

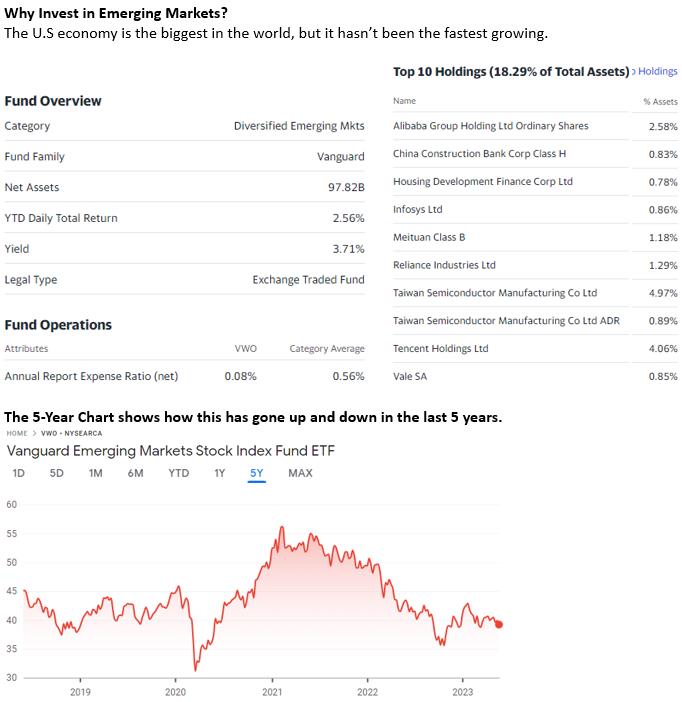

VWO (10% of your Portfolio)

Why Invest in Emerging Markets? The U.S economy is the biggest in the world, but it hasn’t been the fastest growing.Advantages of investing in emerging markets • Growth. The biggest advantage of emerging market investments is the potential for high growth. • Diversification. International investments can be a good diversifier for your investment portfolio because economic downturns in one country or region, including the U.S., can be offset by growth in another.

Risks of investing in emerging markets • Political risk. Emerging markets may have unstable, even volatile, governments. Political unrest can cause serious consequences to the economy and investors. • Economic risk. These markets may often suffer from insufficient labor and raw materials, high inflation or deflation, unregulated markets and unsound monetary policies. All these factors can present challenges to investors. • Currency risk. The value of emerging market currencies compared to the dollar can be extremely volatile. Any investment gains can be potentially lessened if a currency is devalued or drops significantly.

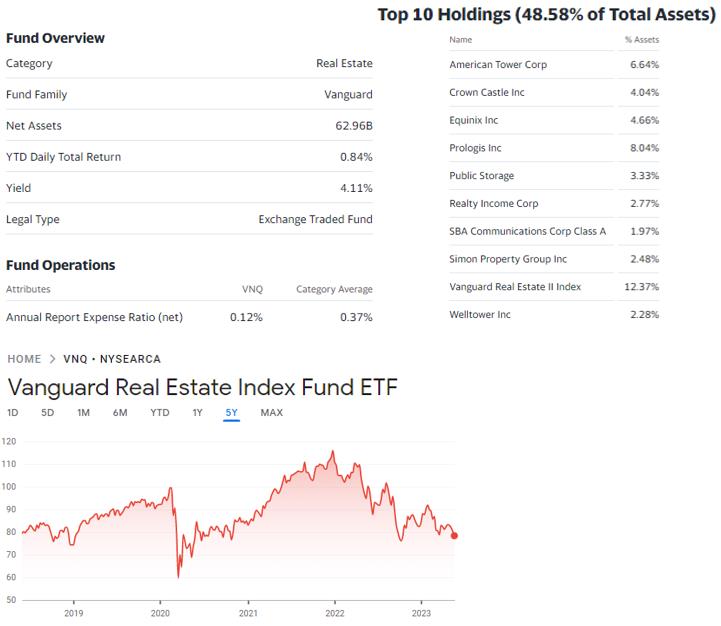

VNQ (10% of your Portfolio)

Why Invest in Real Estate? This is an asset that can diversify you investments in stocks. Historically it has been a good hedge against inflation and is more stable than stocks, although like stocks, there have been long periods of decline.

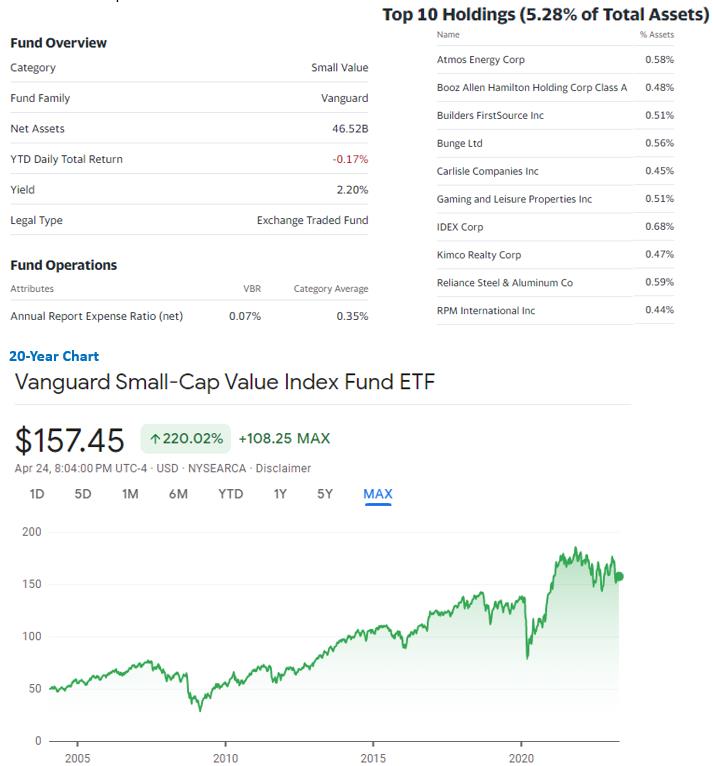

VBR (10% of your Portfolio)

Mutual fund investors favor the Russell 2000 Index because it reflects the investment opportunity presented by the entire market rather than opportunities offered by narrower indices, which may contain bias or more stock-specific risk that can distort a fund manager's performance. This will help to balance out the portfolio.

COMMENT BOARD [00055]

Please keep things family friendly, since we are a civilized community here at alanharmon.net! - (CPC Ver 0.01a)

Hello!

My Name is Alan Harmon. I am a Jesus Follower, Husband, Father, Uncle, Friend, and an Engineer with an MBA.

My interests are in Traveling, Investing, Cooking, Gardening, Technology, Business, Hiking, Smart Homes, Family Games, Automation, and Programming.

Most of the information on this website is centered around those interests. I created this website many years ago primarily to share my recipes and some investing advice, but I began to take it a bit more serious in July of 2023.

I hope you find something Useful here. If you do, you can comment below and share this website with others! Enjoy!