Blog Overview

I started blogging again in July 2023 after some shifting of my job responsibilities, and my children growing up which gave me a lot more discretionary time. I do this for me, but I hope some others find my posts interesting or useful in some way.I am Buying The Dip in my 'Set-It and Forget-It Portfolio'

10/18/2023 by Alan

The major indexes are off from their highs, but also my diversified funds are down as well from my recent purchases in March and September. Here is what I am doing.....

Post Content, Images & Videos

The major indexes are off from their highs, but also my diversified funds (that I call the 'Set-It and Forget-It Portfolio') are down as well from my recent purchases in March 2023 and September 2023.

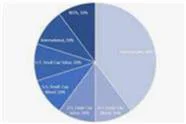

Set-It and Forget-It Portfolio Performance Since 4/24/2023

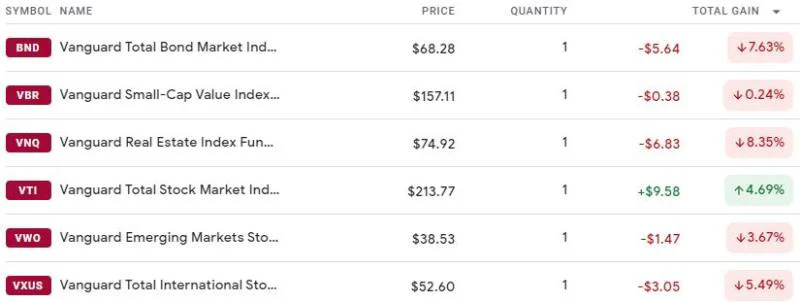

I have been tracking the perfomance of this portfolio since 4/24/2023, and will continue to track this on this website.BND - actually no loss (currently paying 5.4%)

I am only buying real bonds (US Bonds, Short Term Treasuries) so there is no loss here. I am waiting until the fed actually reverses course and lowers the federal funds rate before I buy bonds. I just don't trust the Federal Reserve will lower rates, so the prudent course is to just wait until they ACTUALLY LOWER THEM, not just read an article that predicts they will, or I listen to someone who thinks they will. There is just too much uncertainty for anyone to actually know.VBR - Down 0.24%

VNQ - Down 8.35%

VTI - Up 4.69%

VWO - Down 3.67%

VXUS - Down 5.49%

There is a lot of uncertaintly right now with the Israel-Hamas War just starting (which I think will get much uglier soon and probably expand), the US House Speaker role unfilled (without any chance in sight now that Jim Jordan just lost a second vote), and the Bond Market continuing to have higher interest rates (which is taking money out of the stock market and putting it into bonds).The 'Set-It and Forget-It Portfolio' Performance Since 4/24/2023

BND (20%) - Vanguard Total Bond Market Index

REMEMBER, This is the exception to my portfolio. I am not buying this. I am buying 1-year bonds at 5.478%. There is no risk at all to buying bonds if you hold them to maturity. 10-year bonds hit 5.062% just now. That is so much higher than they have been in the recent years.

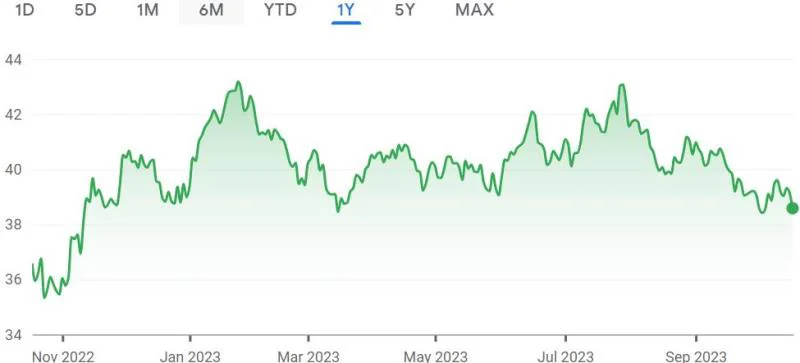

VBR (10%) - Vanguard Small-Cap Value Index

Small caps have come off there year highs and are now back closer to their one-year lows.

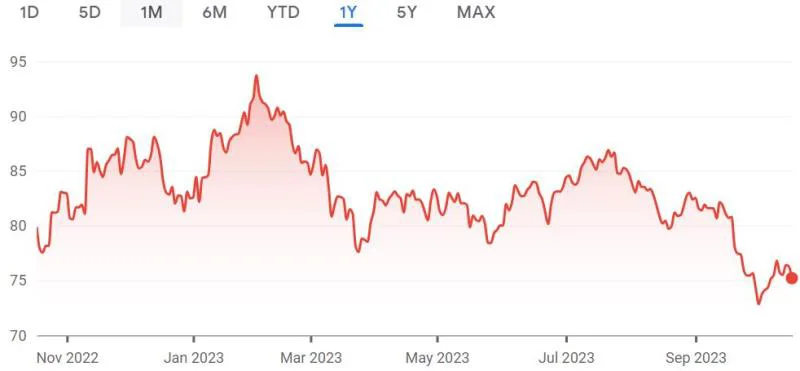

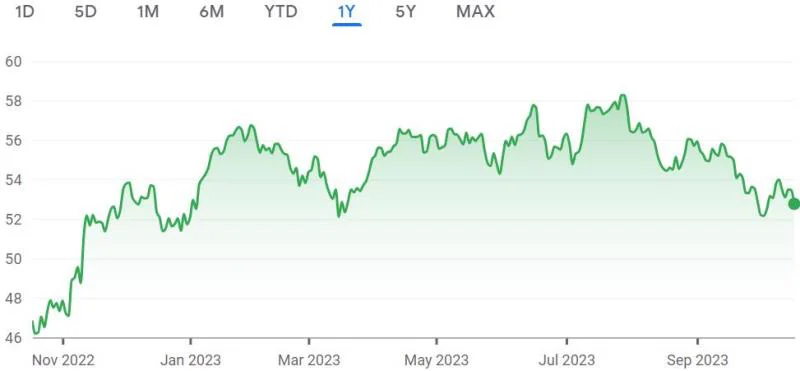

VNQ (10%) - Vanguard Real Estate Index

Real Estate has been struggling in 2023, and it is near its one-year low from two weeks ago. I think real estate will continue to struggle, but I will keep dollar cost average down if that is the case - remember no one knows for sure, and what you 'think' is often the opposite of what actually happens.

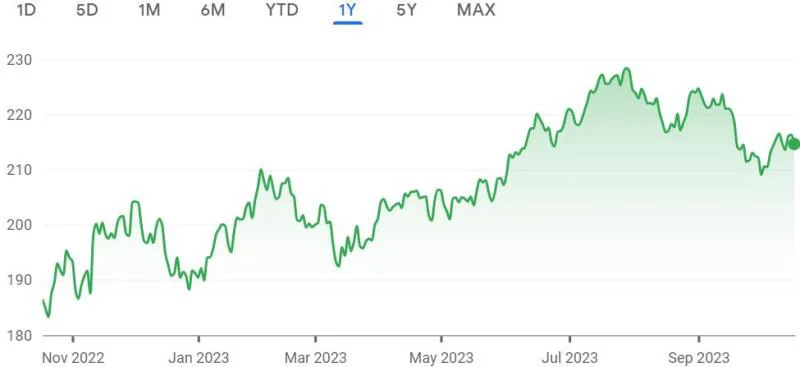

VTI (30%) - Vanguard Total Stock Market Index

This fund is closest to the S&P 500 Index which has been up all year.

VWO (10%) - Vanguard Emerging Markets Stock Index

VXUS (20%) - Vanguard Total International Stock Index

Post Metadata

- Post Number: 108

- Year: 2023

- Slug: i-am-buying-the-dip-in-my-set-it-and-forget-it-portfolio

- Author: Alan

- Categories: Finance

- Subcategories: Investing

- Tags:

- Keywords: buythedip, buyingthedip

- Language Code: en

- Status: published

- Show On Homepage: 1

- Date Created: 10/18/2023

- Last Edited: 10/18/2023

- Date To Show: 10/18/2023

- Last Updated: 7/1/2025

- Views: 0

- Likes: 0

- Dislikes: 0

- Comments: 0